This ratio helps your lender understand your financial capacity to pay your mortgage each month. This rule says that your mortgage payment shouldn’t go over 28% of your monthly pre-tax income and 36% of your total debt. One of the rules you may hear as a homebuyer is the 28/36 rule or the debt-to-income (DTI) rule.

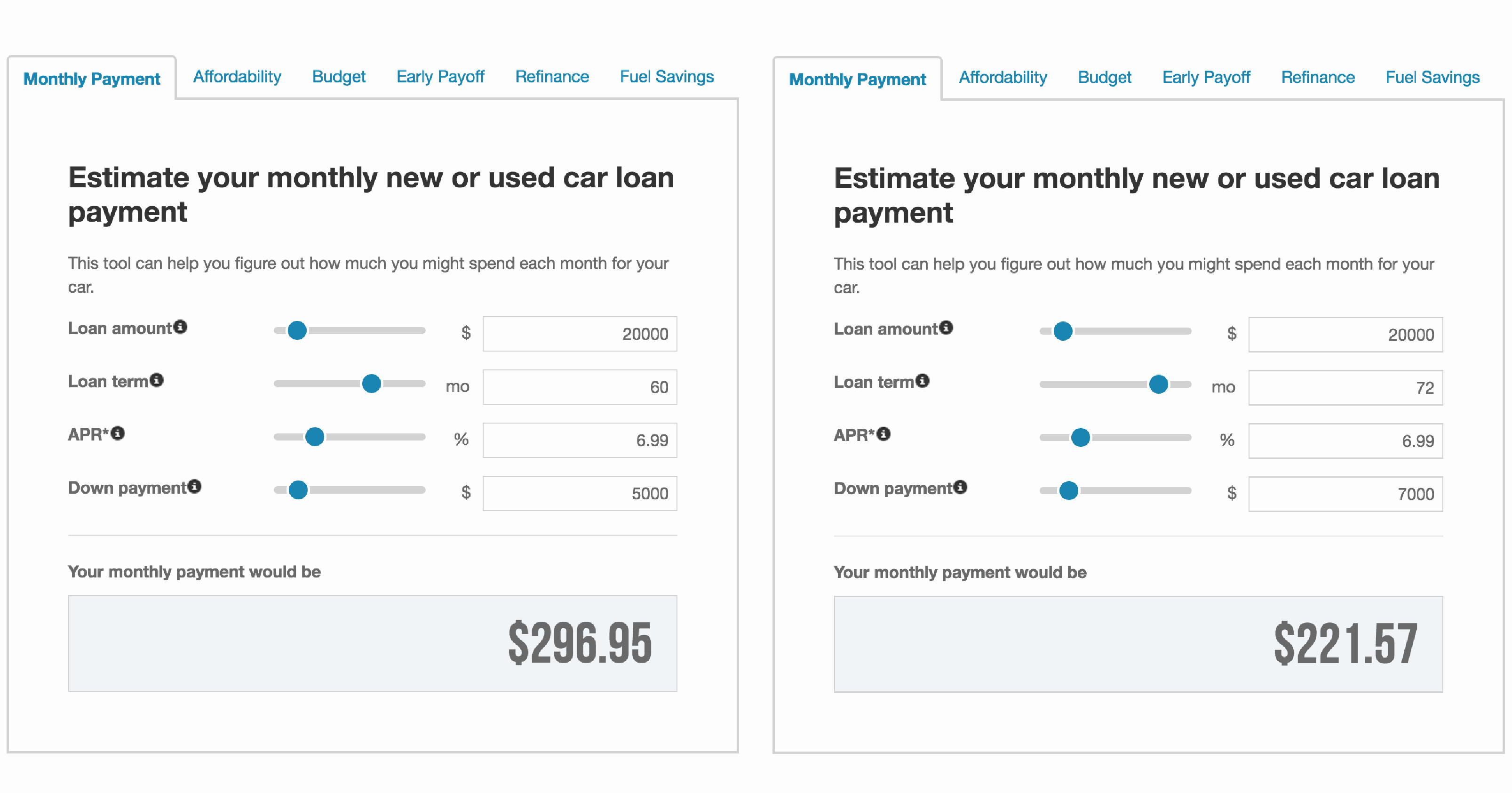

Home price, the first input for our calculator, is based on your income, monthly debt payment, credit score and down payment savings. Here’s a breakdown with an explanation of each factor and how it influences your payment. SmartAsset’s mortgage payment calculator considers four factors - your home price, down payment, mortgage interest rate and loan type - to estimate how much you will pay each month. Factors That Determine Your Mortgage Payment The numbers can always be adjusted later.įor a more detailed monthly payment calculation, click the dropdown for “Taxes, Insurance & HOA Fees.” Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable. Don’t worry if you don’t have exact numbers to work with - use your best guess. In the dropdown box, choose your loan term. There are three fields to fill in: home price, down payment and mortgage interest rate.

The first step to determining what you’ll pay each month is providing background information about your prospective home and mortgage. N = Number of Monthly Payments for 30-Year Mortgage (30 * 12 = 360, etc.) How SmartAsset's Mortgage Payment Calculator Works P = Principal Amount (initial loan balance) Mortgage Payment Formulaįor those who want to know the math that goes into calculating a mortgage payment, we use the following formula to determine a monthly estimate:

#Extra payment mortgage calculator report free#

To find a financial advisor who serves your area, try our free online matching tool. You can also try our home affordability calculator if you’re not sure how much money you should budget for a new home.Ī financial advisor can aid you in planning for the purchase of a home. You can adjust the home price, down payment and mortgage terms to see how your monthly payment will change.

#Extra payment mortgage calculator report download#

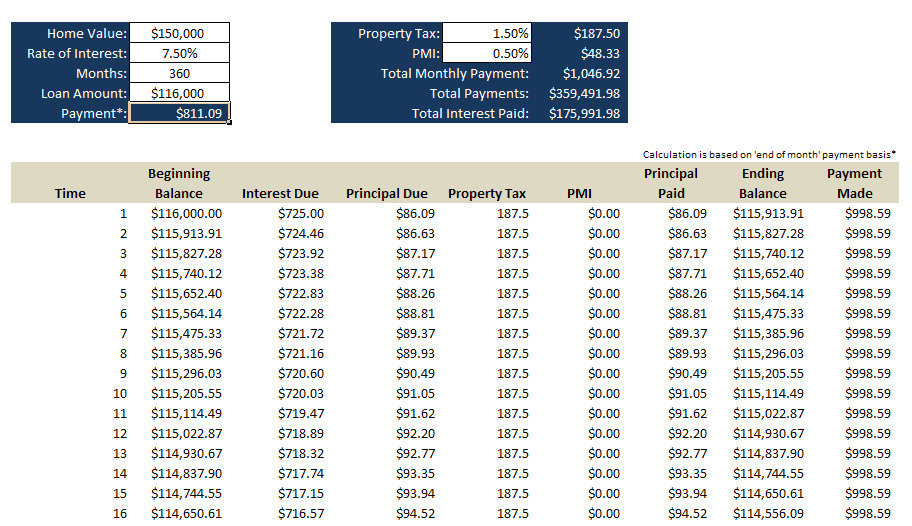

We can visualize the impact with a nice chart (requires some extra work) like this:ĭo check the download workbook for details on how the chart is setup.SmartAsset’s mortgage calculator estimates your monthly mortgage payment, including your loan's principal, interest, taxes, homeowners insurance and private mortgage insurance (PMI). Go ahead and play with the table by typing some values in the “Extra payment” column. Step 3: Your mortgage will end when the “Eff. Closing Balance is opening balance minus principal paid minus extra payment.Ĭomplete this table with necessary formulas and fill everything down.Extra Payment is the input column where we can type any extra payments.We can get this with the PPMT() function. Principal Paid is the amount of principal paid in each month.=ROUND(NPER($E$7/12,$E$10,$D13),0) will tell us how many months it is rounded. We can use NPER function to get the answer here. Effective term is how long it would take you to pay off the mortgage based on the opening balance, and agreed upon monthly payment (calculated in Step 1) and interest rate (Cell E7).For subsequent months, this will same as previous month’s closing balance. Opening Balance is same as loan amount for month=1.Related: Read about SEQUENCE and other Dynamic Array functions in Excel. You can use =SEQUENCE(360) to automatically generate all the months. So, set up a range of 360 months (or longer if you want to cater for longer mortgages). In my case, let’s say loan is $500,000, term is 20 years and APR (Interest rate) is 5.35% per annum.Īs extra payment will bring down the outstanding loan term, we need to set up an amortization table to see the impact clearly. Step 1: Calculate the monthly (or weekly / fortnightly) payment:Īssuming you have the Loan amount, term & APR in three cells E5, E6 & E7, we can use the PMT() function to calculate the periodic payment.

0 kommentar(er)

0 kommentar(er)